Case Studies

Our Success Stories

How NCRi's Website Design Transformed Manāfa into a Fintech Leader

Client's Challenge

Manāfa needed a visually stunning and highly functional website to effectively communicate its value and grow its business.

Solutions Provided by NCRi

NCRI Tech Solutions partnered with Manāfa to deliver a world-class website by leveraging:

- Deep expertise in the Fintech industry.

- A robust technology stack (JavaScript, WordPress, PHP, MySQL).

- A structured and collaborative design and development process.

- Ongoing support and maintenance.

Results Achieved

A scalable, secure, and user-friendly platform that exceeded client expectations and positioned Manāfa as a leader in the Fintech industry.

How NCRi Built a Scalable Digital Learning Platform for Diageo Bar Academy

Client's Challenge

Create a scalable, high-performance digital learning platform with advanced search, robust admin controls, and multilingual support for a global audience.

Solutions Provided by NCRi

Implemented a strategic approach using a modern tech stack (ReactJS, NextJS, Node.js, AWS) to deliver a platform with advanced search functionality, a secure admin panel, and multilingual capabilities.

Results Achieved

A seamless and engaging digital learning experience that enhanced Diageo Bar Academy's presence and met the needs of hospitality professionals worldwide.

NCRi's Website Redesign Boost a Manufacturing Enterprise's Digital Presence

Client's Challenge

Outdated site, and Poor SEO Immediate deployment of a senior-level Network Engineer to optimize WAN/LAN infrastructure, enhance network resilience, and ensure 24/7 uptime for mission-critical systems.

Solutions Provided by NCRi

Mobile first redesign, SEO optimization, IDX integration

- Activated Talent Acquisition pipeline leveraging NCRi’s top-rated, pre-vetted talent pool.

- Shortlisted 3 senior engineers within 48 hours through a competency-based screening model.

- Successfully deployed a Certified Network Engineer (CCNP/SD-WAN Specialist) aligned with client’s tech stack and ITIL framework.

Results Achieved

- 45% reduction in network latency post-optimization.

- Achieved 99.99% uptime across client’s distributed infrastructure.

- Seamless knowledge transfer ensured long-term in-house team enablement.

- Strengthened NCRi’s reputation as a strategic HR partner for mission-critical IT staffing.

NCRi's Cloud Solutions Cut a FinTech's Costs and Ensured Compliance

Client's Challenge

The client was undergoing a cloud transformation initiative, migrating legacy systems to AWS & Azure. They faced:

- A shortage of Cloud Solutions Architects and DevOps Engineers with expertise in Kubernetes, Terraform, and CI/CD pipelines.

- Delays in migration roadmap, risking compliance deadlines with SOC 2 & PCI DSS standards.

- Increased costs due to underutilized cloud resources.

Solutions Provided by NCRi

- Deployed a specialized team of 3 Cloud Engineers and 2 DevOps Specialists within 2 weeks through staff augmentation.

- Experts vetted through NCRi’s multi-stage technical screening & live project simulation hackathons.

- Delivered cloud optimization strategies, including auto-scaling policies, IaC (Infrastructure as Code) with Terraform, and enhanced CI/CD pipelines.

Results Achieved

- Achieved 40% faster migration timeline with zero downtime.

- Reduced monthly cloud spend by 30% through optimized resource allocation.

- Successfully passed SOC 2 compliance audit ahead of schedule.

- Client extended NCRi’s engagement into a long-term strategic partnership.

Our Success Stories

NCRi Helps a Telecom Company Improve CSAT by 35% with AI-Driven Inbound Support

Client's Challenge

High call volumes causing SLA breaches and 20% customer churn.

Solution Provided by NCRi

Implemented 24/7 inbound support with multilingual agents and AI-driven IVR routing.

Results Achieved

- CSAT, up by 35%

- FCR improved to 92%

- Churn reduced by 18%

How NCRi Helped a FinTech Startup Double its Conversion Rate?

Client's Challenge

Low lead-to-sale conversion (4%) with rising acquisition costs.

Solution Provided by NCRi

Trained agents on consultative selling, integrated CRM with automated follow-ups.

Results Achieved

- Conversions doubled to 9%

- CPA reduced by 27%

- $2.4M revenue pipeline created in 6 months

How NCRi Improved Customer Experience and Reduced Errors by 45% for an E-commerce Brand?

Client's Challenge

: Inconsistent CX due to agent performance gaps.

Solution Provided by NCRi

Implemented QA framework with 100% call monitoring & weekly coaching.

Results Achieved

- NPS jumped by 28 points

- Error rate reduced by 45%

- AHT optimized by 15%

NCRi Helps a Healthcare Provider Achieve 99.5% SLA Compliance with Multichannel Support?

Client's Challenge

High inbound queries (phone, chat, email) causing backlog and compliance risk.

Solution Provided by NCRi

Centralized omnichannel support with HIPAA-trained agents.

Results Achieved

- Backlog cleared in 30 days

- SLA compliance 99.5%

- Patient satisfaction score +31%

NCRi's Outbound Strategy Reduces Delinquency by 33% for a Utility Company

Client's Challenge

Late payments and rising delinquency impacting cash flow.

Solution Provided by NCRi

Outbound reminder campaigns + empathy-based collections.

Results Achieved

- Delinquency reduced by 33%

- Retention rate up by 21%

- $18M recovered in 12 months

Our Success Stories

NCRi Helps a SaaS Startup Achieve 2.8x ROI on Ad Spend

Client's Challenges

- Low lead-to-customer conversion rates.

- Inefficient ad spend on nonqualified leads.

Solutions Provided by NCRi

- Deployed data-driven ad targeting on LinkedIn & Google.

- Optimized landing pages using A/B testing & heatmap analysis.

Results Achieved

- 3.5x increase in qualified leads.

- 40% lower CAC (Customer Acquisition Cost).

- 2.8x ROI on ad spend.

- Precision targeting

- Measurable ROI

How NCRi Drove a 120% Follower Growth for a Fashion Brand?

Client's Challenges

- Weak brand visibility on Instagram & TikTok.

- Low engagement rates despite frequent posting.

Solutions Provided by NCRi

- Designed a content calendar with influencer collaborations.

- Leveraged AI-driven sentiment analysis to optimize campaigns.

Results Achieved

- 120% growth in followers in 6 months.

- 3x increase in engagement rate.

- 25% boost in sales attributed to social traffic.

- Stronger digital presence

- Sales-driven engagement

A Modern Website by NCRi Leads to Faster Load Speeds and More Appointments

Client's Challenges

- Outdated website with poor UI/UX and load times.

- Low appointment bookings through online platform.

Solutions Provided by NCRi

- Delivered a responsive, SEO-optimized website.

- Integrated online booking & chatbot support.

Results Achieved

- 65% increase in organic traffic.

- 40% rise in online appointments.

- 80% faster page load speed.

- Patient-friendly digital experience

- SEO + UX optimization

How NCRi Helped a B2B Manufacturer Increase Inbound Leads by 4x?

Client's Challenges

- No structured thought-leadership content.

- Weak brand authority in niche B2B market.

Solutions Provided by NCRi

- Created whitepapers, case studies, and industry blogs.

- Optimized distribution via LinkedIn Ads & email nurture flows.

Results Achieved

- 4x increase in inbound leads.

- 35% more website authority (Domain Rating).

- 50% boost in lead-to-opportunity conversion rate.

- Positioning as industry authority

- Consistent inbound pipeline

How NCRi's Automated Email Campaigns Increased Repeat Purchases by 3x?

Client's Challenges

- High cart abandonment rate.

- No structured customer re-engagement strategy.

Solutions Provided by NCRi

- Implemented automated drip campaigns & abandoned-cart flows.

- Personalized content using AI-driven customer segmentation.

Results Achieved

- 28% recovery of abandoned carts.

- 3x increase in repeat purchases.

- 22% higher customer lifetime value (CLV).

- Automated engagement

- Higher repeat sales

NCRi's SEO & SEM Strategy Led to 45% More Demo Requests for a FinTech Firm

Client's Challenges

- Limited search visibility in highly competitive fintech space.

- High dependency on paid ads with low organic traffic.

Solutions Provided by NCRi

- Conducted SEO audit & keyword gap analysis.

- Optimized SEM campaigns with quality score improvements.

Results Achieved

- 200% growth in organic traffic within 8 months.

- 30% lower CPC (Cost per click).

- 45% more inbound demo requests.

- Balanced SEO + paid strategy

- Sustainable lead generation

Our Success Stories

How NCRi's AI-Powered Strategy Reduced Time-to-Hire by 40% for a Global Tech Firm?

Client's Challenges

- High attrition in senior developer roles due to poor role alignment.

- Lengthy time-to-hire slowing product deployment schedules.

Solutions Provided by NCRi

- Conducted competency-based assessments and behavioral interviews.

- Deployed an AI-enabled applicant tracking system to accelerate screening.

Results Achieved

- 40% reduction in time-to-hire.

- 95% job-role fit validated within probation period.

- 25% decrease in attrition for critical skill sets.

- Optimized recruitment funnel

- Data-driven hiring strategy

NCRi Reduces Payroll Processing Time by 60% for a National Retail Chain

Client's Challenges

- High frequency of payroll discrepancies, undermining employee satisfaction.

- Compliance gaps in multi-jurisdictional payroll management.

Solutions Provided by NCRi

- Implemented a cloud-based payroll automation platform.

- Integrated real-time compliance monitoring across geographies.

Results Achieved

- 98% payroll accuracy achieved.

- 60% reduction in processing cycle time.

- Zero compliance breaches in 12 months.

- Streamlined payroll governance

- Boosted workforce confidence

NCRi Helps a Manufacturing Enterprise Increase KPI Achievement Rates by 30%

Client's Challenges

- Lack of KPI alignment between production and operations teams.

- Absence of structured performance management framework.

Solutions Provided by NCRi

- Designed role-specific KPIs aligned with organizational goals.

- Introduced a performance dashboard with predictive analytics.

Results Achieved

- 20% improvement in operational productivity.

- 15% uplift in employee engagement index.

- 30% increase in KPI achievement rates.

- Goal alignment across functions

- Measurable productivity outcomes

How NCRi's Psychometric Assessments Reduced Turnover by 25% in the Banking Sector?

Client's Challenges

- High-pressure roles leading to employee burnout and short tenure cycles.

- Difficulty in identifying resilient, high-potential talent.

Solutions Provided by NCRi

- Conducted psychometric profiling and resilience testing.

- Implemented leadership readiness assessments for succession planning.

Results Achieved

- 25% decrease in turnover for high-stress functions.

- 40% increase in leadership pipeline quality.

- Improved employee well-being index across departments.

- Strengthened workforce resilience

- Proactive succession planning

NCRi Helps a Healthcare Network Achieve 100% HR Digitalization

Client's Challenges

- Overreliance on manual HR operations causing delays in decision-making.

- Lack of centralized employee lifecycle management.

Solutions Provided by NCRi

- Deployed an HRIS platform integrating payroll, leave, and performance.

- Enabled real-time workforce analytics dashboards.

Results Achieved

- 70% acceleration in HR transaction processing.

- 100% digitization of employee records.

- 35% faster query resolution through self-service portals.

- Automated end-to-end HR workflows

- Data-driven workforce management

How NCRi Reduced Attrition by 12% for a Unionized Logistics Workforce?

Client's Challenges

- Persistent grievances and disputes in unionized workforce.

- High attrition caused by ineffective employee relations management.

Solutions Provided by NCRi

- Rolled out conflict resolution frameworks and mediation programs.

- Delivered managerial training on labor relations and communication.

Results Achieved

- 30% reduction in workplace disputes.

- 12% lower attrition rate.

- 20% increase in employee satisfaction scores.

- Improved labor-management relations

- Sustainable workforce retention

Our Success Stories

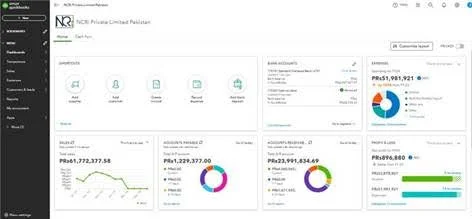

Figure The accompanying snapshot presents a live financial overview, highlighting AR/AP balances, categorized expenses, and net profitability—demonstrating an optimized accounting environment built to support scale and strategic planning.

Full-Scope Bookkeeping, AP/AR Management, Financial Reporting for a Growing Financial Services Startup

Client's Challenges

With a rapidly expanding operational footprint, client required a scalable bookkeeping solution capable of handling high transaction volumes, streamlining accounts payable and receivable processes, and maintaining real-time visibility into cash flow—without disrupting day-to-day operations.

Solutions Provided by NCRi

A full-cycle bookkeeping framework was deployed through QuickBooks Online, featuring:

- Customized dashboard setup and optimization

- Daily reconciliation of multiple active bank accounts

- Complete management of the AP/AR lifecycle, including invoicing, payment tracking, and follow-ups

- Monthly generation of key financial reports, including Profit & Loss statements, Cash Flow reports, and Expense breakdowns for executive-level analysis

Results Achieved

- 30% reduction in time required for month-end closing procedures

- Real-time financial visibility to support informed decision-making

- Seamless cash flow monitoring across multiple departments and cost centers

- Monthly generation of key financial reports, including Profit & Loss statements, Cash Flow reports, and Expense breakdowns for executive-level analysis

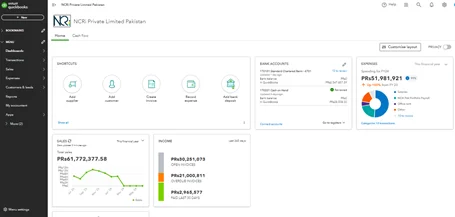

Figure The dashboard configuration shown reflects an optimized accounting environment designed for efficiency, clarity, and strategic financial management—providing leadership with immediate access to critical financial indicators.

How NCRi's Quickbooks Dashboard Gave a Business 100% Invoice Visibility?

Client's Challenges

A scalable financial monitoring system was required to support rapid organizational growth, with specific emphasis on tracking income channels, identifying overdue receivables, and maintaining control over key expense categories.

Solutions Provided by NCRi

A customized QuickBooks dashboard was configured to support:

- Real-time visibility into monthly revenue performance

- Automated tracking and status updates of open and overdue invoices

- Detailed categorization of operational expenditures (e.g., payroll, occupancy, and overheads)

- Centralized reporting of income streams and bank balances for executive review

Results Achieved

- Delivered actionable insights into rising expense trends for FY24 planning

- Achieved 100% invoice visibility and improved collection follow-up cycles

- Streamlined reconciliation across multiple banking channels

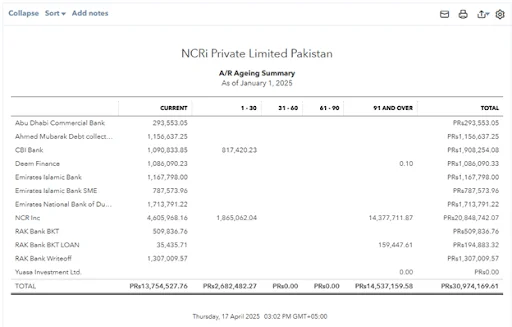

Figure This report demonstrates a methodical approach to receivables management—delivering actionable insights that strengthen working capital control and support business continuity.

Structured A/R Ageing Reports for Informed Receivables Management

Client's Challenges

The organization required clear visibility into aged receivables to improve collection efficiency, manage cash flow more effectively, and reduce outstanding balances.

Solutions Provided by NCRi

As part of the monthly financial reporting process, a customized Accounts Receivable Ageing Report was implemented to segment receivables by age brackets (Current, 1–30, 31–60, 91+ days). This structured approach provided clarity on overdue invoices and supported targeted follow-up strategies.

Results Achieved

- ₹30M+ in receivables tracked with full transparency

- ₹14.5M identified in 91+ day overdue accounts for priority collection

- Noticeable reduction in collection delays and payment risks

- Improved alignment between accounts and client-facing departments for timely communication

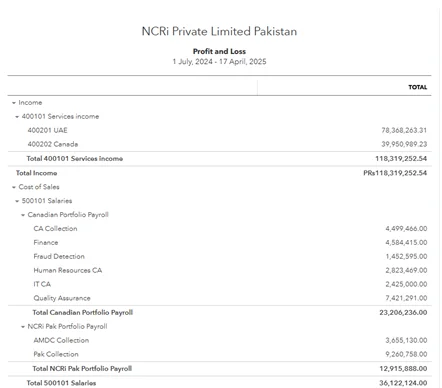

Figure: This P&L report reflects our commitment to providing precise, actionable financial reporting—equipping our clients with the insights they need to manage growth effectively and make confident business decisions.

Delivering Insightful Profit & Loss Reporting for a Leading BPO

Client's Challenges

To establish a structured and reliable reporting process that delivers clear visibility into income, expenses, and net profitability—supporting strategic planning and financial transparency across departments.

Solutions Provided by NCRi

As part of the ongoing bookkeeping engagement, a tailored Profit & Loss reporting framework was established to ensure structured, accurate, and decision-ready financial insights. The reporting process included:

- Precise classification of income and expense categories

- Generation of monthly P&L statements with period-over-period comparisons

- Detailed breakdowns of gross and net profitability

- Executive-ready reporting formats for strategic review

Results Achieved

- 45% reduction in network latency post-optimization.

- Achieved 99.99% uptime across client’s distributed infrastructure.

- Seamless knowledge transfer ensured long-term in-house team enablement.

- Strengthened NCRi’s reputation as a strategic HR partner for mission-critical IT staffing.

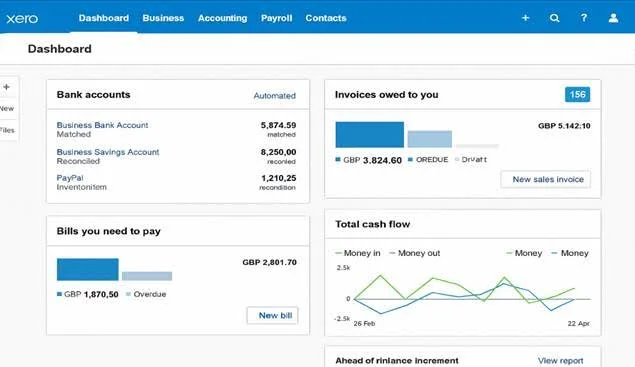

Figure Xero Dashboard showcasing real-time financial insights, including automated bank feeds, outstanding invoices, bills payable, and cash flow trends—enabling accurate, efficient bookkeeping for a growing retail business.

Transitioning from Manual Spreadsheets to Xero for a Small Retail Business

Client's Challenges

The business relied on Excel spreadsheets for daily bookkeeping, leading to frequent data entry errors, limited financial oversight, and time-consuming manual reconciliation. The lack of real-time reporting further impeded strategic decision-making and inventory control.

Solutions Provided by NCRi

A full migration from Excel to Xero was executed to modernize the accounting infrastructure. Key elements of the implementation included:

- Setup and configuration of Xero accounting software

- Activation of automated bank feeds to reduce manual input

- Integration of inventory tracking to align with real-time sales and stock levels

Results Achieved

- 90% reduction in bookkeeping and reconciliation errors

- Approximately 6 hours saved weekly through automation

- Real-time financial visibility and improved operational efficiency

This migration significantly enhanced the client’s ability to manage finances proactively—minimizing errors, saving time, and supporting better retail inventory and cash flow oversight

Figure Power BI dashboard providing real-time cash flow insights—including weekly trends, forecast models, category-level analysis, and monthly inflow/outflow projections—designed to support strategic liquidity planning across multi-location retail operations.

NCRi's Financial Solution Solves Reporting Challenges for a Multi-Location Retailer

Client's Challenges

The retailer managed over 20 store locations with decentralized financial systems, resulting in fragmented insight into cash movements. Key challenges included:

- Limited visibility into consolidated cash inflows and outflows

- Dependence on manual spreadsheets across accounting, inventory, and operations departments

- Inconsistent reporting frequency, leading to reactive financial management

- Recurring liquidity shortfalls and delayed vendor payments

Solutions Provided by NCRi

A centralized and dynamic Power BI dashboard was developed to deliver real-time financial clarity and long-term forecasting. Key components of the solution included:

- Integration of live data sources from bank feeds, AP/AR systems, and procurement platforms

- Automated weekly and monthly cash position reporting across all store locations and at the corporate level

- Rolling 12-month cash flow forecasting based on historical data, seasonality, and payment cycles

- Custom DAX logic enabling dynamic filters for scenario modeling and location-level financial analysis

Results Achieved

- 30% reduction in weekly cash shortages through improved fund allocation and proactive liquidity planning

- Enhanced forecasting precision, particularly during seasonal sales periods

- Strengthened vendor relations through timely payment scheduling and visibility of upcoming obligations

- Implementation of a transparent, forward-looking cash flow model supporting strategic planning for capital expenditures, staffing, and inventory optimization

This dashboard now serves as a strategic financial tool, equipping executive leadership with the insights needed for confident, long-term decision-making across a distributed retail operation.

Our Success Stories

NCRi's AI-Driven Collections Strategy Improves a Saudi Bank's Recovery Rate by 37%

Client's Challenge

A leading Saudi bank struggled with rising NPLs and regulatory scrutiny on collections.

Solution Provided by NCRi

NCRi deployed a bilingual (Arabic–English) collections team with PCI & GDPR compliance, leveraging predictive dialers and AI-driven segmentation.

Results Achieved

- $120M recovered within 9 months

- Recovery rate improved by 37%

- DSO reduced by 22 days

How NCRi's Customer-Focused Strategy Recovered Over $65M for a Dubai Telecom Provider?

Client's Challenge

High churn due to aggressive collections damaging customer relationships.

Solution Provided by NCRi

Implemented customer-retention focused collections with flexible payment plans and omnichannel reminders.

Results Achieved

- $65M+ recovered in 12 months

- Churn reduced by 28%

- Retention rate improved by 19%

NCRi's Empathy-Led Collections Strategy Boosts Success Rate by 41%

Client's Challenge

Credit card delinquencies surged, with over 45% accounts in late-stage collections.

Solution Provided by NCRi

NCRi applied skip-tracing, analytics-based scoring, and empathy-led customer engagement.

Results Achieved

- $200M+ recovered annually

- Collection success rate 41% higher than industry average

- Compliance score 100% (PCI & SOC2 certified)

How NCRi Secured $48M+ in Receivables for a Canadian Healthcare Provider?

Client's Challenge

Patient debt collections were harming hospital-patient relationships.

Solution Provided by NCRi

Designed a pre-delinquency reminder program with sensitive communication and structured repayment plans.

Results Achieved

- Delinquency reduced by 33%

- Patient satisfaction maintained (NPS +24 points)

- $48M+ in receivables secured

NCRi's Multichannel Collections Strategy Reduced Customer Complaints by 21%

Client's Challenge

A major utility company faced high arrears and slow recoveries impacting cash flow.

Solution Provided by NCRi

NCRi rolled out multichannel collections (calls, SMS, letters) with 24/7 contact center support.

Results Achieved

- $95M+ recovered in 18 months

- Collection cycle time reduced by 40%

- Customer complaints decreased by 21%

Our Success Stories

How NCRi VAs Built a Consistent Pipeline for a New York Brokerage?

Client's Challenge

Inconsistent pipeline, high ad costs

Solution Provided by NCRi

Multi-channel outreach, optimized landing pages

Results Achieved

- 300+ warm leads per month

- Email open rate 20% above industry average

- Conversions +15% in 90 days

How NCRi VAs Drove Higher ROI with Multi-Channel Lead Generation?

Client's Challenge

Disorganized CRM, delayed follow-ups (12% conversion)

Solution Provided by NCRi

Salesforce + KVCore automation, data cleanup

Results Achieved

- Response time: 48 hrs → 6 hrs

- 40% duplicates removed

- Conversions +33%

How NCRi VAs Took an E-Commerce Brand from Page 5 to Page 1 on Google?

Client's Challenge

Outdated site, and Poor SEO

Solution Provided by NCRi

Mobile first redesign, SEO optimization, IDX integration

Results Achieved

- SEO rank: Page 5 → Page 1 in 6 months

- Bounce rate reduced by 42%

- Lead forms increased 2.5x

How NCRi VAs Turned Low Ad ROI into $450K+ Pipeline Growth?

Client's Challenge

Weak presence, low ad ROI

Solution Provided by NCRi

Paid campaigns & content strategy

Results Achieved

- 65% engagement growth (3 months)

- 120 qualified leads generated

- $450K+ in pipeline