Finance & Accounts Services

Your Trusted Financial Partner

Empowering Business Growth Through Expert Solutions

-

80+

Global Clients Served -

$500M+

Invoices Processed Every Year -

Expertise Across

QuickBooks, Xero, FreshBooks, Zoho Books, Power BI

Our Core Services

Accounting & Bookkeeping

- Full-cycle AP/AR optimization (Invoice Processing, Vendor & Customer Management)

- Transaction recording & reconciliation (Bank, Credit Card, Multi-currency)

- Custom dashboards for real-time financial insights

- Tax compliance, audit support & financial controls

Proven Impact

Faster month-end closings

Invoice visibility

Reduction in manual errors through automation

Financial Planning & Analysis

- Budgeting & forecasting to align with business goals

- Cash flow projections & scenario planning for risk management

- Variance & KPI reporting for performance tracking

- Executive-ready reporting for stakeholders

Proven Impact

Month rolling forecasts

Reduction in cash shortages

Real-time visibility for leadership decision-making

Why Choose Us?

Certified experts in QuickBooks, Xero, FreshBooks, Zoho Books, Power BI

Precision & accuracy in every transaction

Global experience across IT, Retail, Real Estate, and Financial Services

Timely delivery with actionable insights

Transparent reporting for smarter business moves

Our Success Stories

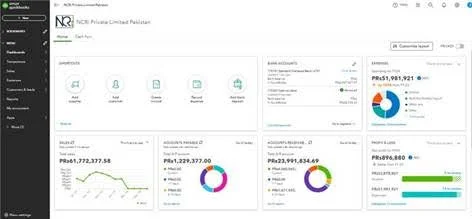

Figure The accompanying snapshot presents a live financial overview, highlighting AR/AP balances, categorized expenses, and net profitability—demonstrating an optimized accounting environment built to support scale and strategic planning.

Full-Scope Bookkeeping, AP/AR Management, Financial Reporting for a Growing Financial Services Startup

Client's Challenges

With a rapidly expanding operational footprint, client required a scalable bookkeeping solution capable of handling high transaction volumes, streamlining accounts payable and receivable processes, and maintaining real-time visibility into cash flow—without disrupting day-to-day operations.

Solutions Provided by NCRi

A full-cycle bookkeeping framework was deployed through QuickBooks Online, featuring:

- Customized dashboard setup and optimization

- Daily reconciliation of multiple active bank accounts

- Complete management of the AP/AR lifecycle, including invoicing, payment tracking, and follow-ups

- Monthly generation of key financial reports, including Profit & Loss statements, Cash Flow reports, and Expense breakdowns for executive-level analysis

Results Achieved

- 30% reduction in time required for month-end closing procedures

- Real-time financial visibility to support informed decision-making

- Seamless cash flow monitoring across multiple departments and cost centers

- Monthly generation of key financial reports, including Profit & Loss statements, Cash Flow reports, and Expense breakdowns for executive-level analysis

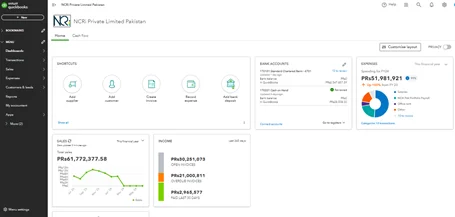

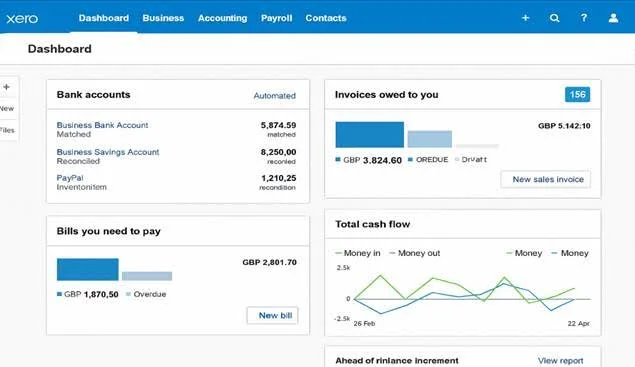

Figure The dashboard configuration shown reflects an optimized accounting environment designed for efficiency, clarity, and strategic financial management—providing leadership with immediate access to critical financial indicators.

How NCRi's Quickbooks Dashboard Gave a Business 100% Invoice Visibility?

Client's Challenges

A scalable financial monitoring system was required to support rapid organizational growth, with specific emphasis on tracking income channels, identifying overdue receivables, and maintaining control over key expense categories.

Solutions Provided by NCRi

A customized QuickBooks dashboard was configured to support:

- Real-time visibility into monthly revenue performance

- Automated tracking and status updates of open and overdue invoices

- Detailed categorization of operational expenditures (e.g., payroll, occupancy, and overheads)

- Centralized reporting of income streams and bank balances for executive review

Results Achieved

- Delivered actionable insights into rising expense trends for FY24 planning

- Achieved 100% invoice visibility and improved collection follow-up cycles

- Streamlined reconciliation across multiple banking channels

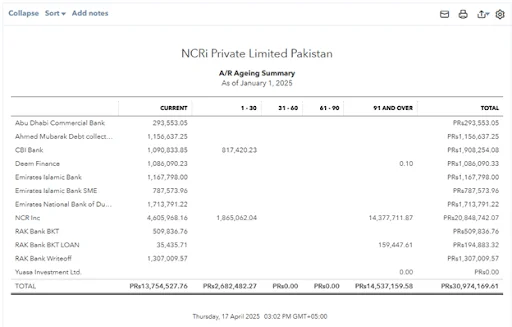

Figure This report demonstrates a methodical approach to receivables management—delivering actionable insights that strengthen working capital control and support business continuity.

Structured A/R Ageing Reports for Informed Receivables Management

Client's Challenges

The organization required clear visibility into aged receivables to improve collection efficiency, manage cash flow more effectively, and reduce outstanding balances.

Solutions Provided by NCRi

As part of the monthly financial reporting process, a customized Accounts Receivable Ageing Report was implemented to segment receivables by age brackets (Current, 1–30, 31–60, 91+ days). This structured approach provided clarity on overdue invoices and supported targeted follow-up strategies.

Results Achieved

- ₹30M+ in receivables tracked with full transparency

- ₹14.5M identified in 91+ day overdue accounts for priority collection

- Noticeable reduction in collection delays and payment risks

- Improved alignment between accounts and client-facing departments for timely communication

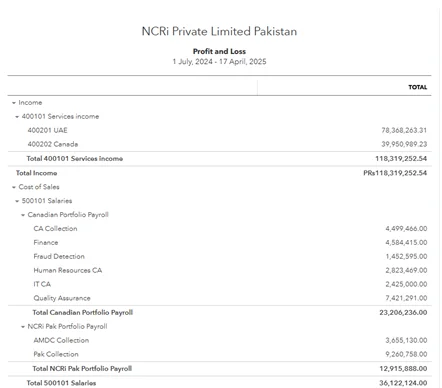

Delivering Insightful Profit & Loss Reporting for a Leading BPO

Client's Challenges

To establish a structured and reliable reporting process that delivers clear visibility into income, expenses, and net profitability—supporting strategic planning and financial transparency across departments.

Solutions Provided by NCRi

As part of the ongoing bookkeeping engagement, a tailored Profit & Loss reporting framework was established to ensure structured, accurate, and decision-ready financial insights. The reporting process included:

- Precise classification of income and expense categories

- Generation of monthly P&L statements with period-over-period comparisons

- Detailed breakdowns of gross and net profitability

- Executive-ready reporting formats for strategic review

Results Achieved

- Improved visibility into financial performance across business units

- Enabled leadership to identify expense trends and cost-saving opportunities

- Supported timely and informed budget allocation and forecasting

- Reinforced compliance and reporting accuracy for stakeholder presentations

Figure: This P&L report reflects our commitment to providing precise, actionable financial reporting—equipping our clients with the insights they need to manage growth effectively and make confident business decisions.

Transitioning from Manual Spreadsheets to Xero for a Small Retail Business

Client's Challenges

The business relied on Excel spreadsheets for daily bookkeeping, leading to frequent data entry errors, limited financial oversight, and time-consuming manual reconciliation. The lack of real-time reporting further impeded strategic decision-making and inventory control.

Solutions Provided by NCRi

A full migration from Excel to Xero was executed to modernize the accounting infrastructure. Key elements of the implementation included:

- Setup and configuration of Xero accounting software

- Activation of automated bank feeds to reduce manual input

- Integration of inventory tracking to align with real-time sales and stock levels

Results Achieved

- 90% reduction in bookkeeping and reconciliation errors

- Approximately 6 hours saved weekly through automation

- Real-time financial visibility and improved operational efficiency

This migration significantly enhanced the client’s ability to manage finances proactively—minimizing errors, saving time, and supporting better retail inventory and cash flow oversight

Figure Xero Dashboard showcasing real-time financial insights, including automated bank feeds, outstanding invoices, bills payable, and cash flow trends—enabling accurate, efficient bookkeeping for a growing retail business.

NCRi's Financial Solution Solves Reporting Challenges for a Multi-Location Retailer

Client's Challenges

The retailer managed over 20 store locations with decentralized financial systems, resulting in fragmented insight into cash movements. Key challenges included:

- Limited visibility into consolidated cash inflows and outflows

- Dependence on manual spreadsheets across accounting, inventory, and operations departments

- Inconsistent reporting frequency, leading to reactive financial management

- Recurring liquidity shortfalls and delayed vendor payments

Solutions Provided by NCRi

A centralized and dynamic Power BI dashboard was developed to deliver real-time financial clarity and long-term forecasting. Key components of the solution included:

- Integration of live data sources from bank feeds, AP/AR systems, and procurement platforms

- Automated weekly and monthly cash position reporting across all store locations and at the corporate level

- Rolling 12-month cash flow forecasting based on historical data, seasonality, and payment cycles

- Custom DAX logic enabling dynamic filters for scenario modeling and location-level financial analysis

Results Achieved

- 30% reduction in weekly cash shortages through improved fund allocation and proactive liquidity planning

- Enhanced forecasting precision, particularly during seasonal sales periods

- Strengthened vendor relations through timely payment scheduling and visibility of upcoming obligations

- Implementation of a transparent, forward-looking cash flow model supporting strategic planning for capital expenditures, staffing, and inventory optimization

This dashboard now serves as a strategic financial tool, equipping executive leadership with the insights needed for confident, long-term decision-making across a distributed retail operation.

Figure Power BI dashboard providing real-time cash flow insights—including weekly trends, forecast models, category-level analysis, and monthly inflow/outflow projections—designed to support strategic liquidity planning across multi-location retail operations.

Let’s Transform Your Finances

Whether you need accurate bookkeeping or strategic FP&A, our finance experts deliver solutions that fuel growth.