Dear Readers,

Let’s talk about something that may not sound exciting at first—but is absolutely essential to any company’s financial health: the Accounts Receivable Aging Report (AR Aging Report).

If you’ve ever wondered, “Why are we not getting paid on time?” or “Which customers might become a risk?”, this report is all you need.

In business finance, maintaining healthy cash flow is not just a goal—it is a necessity. One of the most effective tools to ensure this is the Accounts Receivable Aging Report (AR Aging Report).

If you’ve ever asked, “How long have these payments been pending?” or “Which clients are becoming a credit risk?”—this report holds the answers.

This is how we leverage this document to monitor and manage outstanding customer invoices at NCRi.

So What is an Accounts Receivable Aging Report?

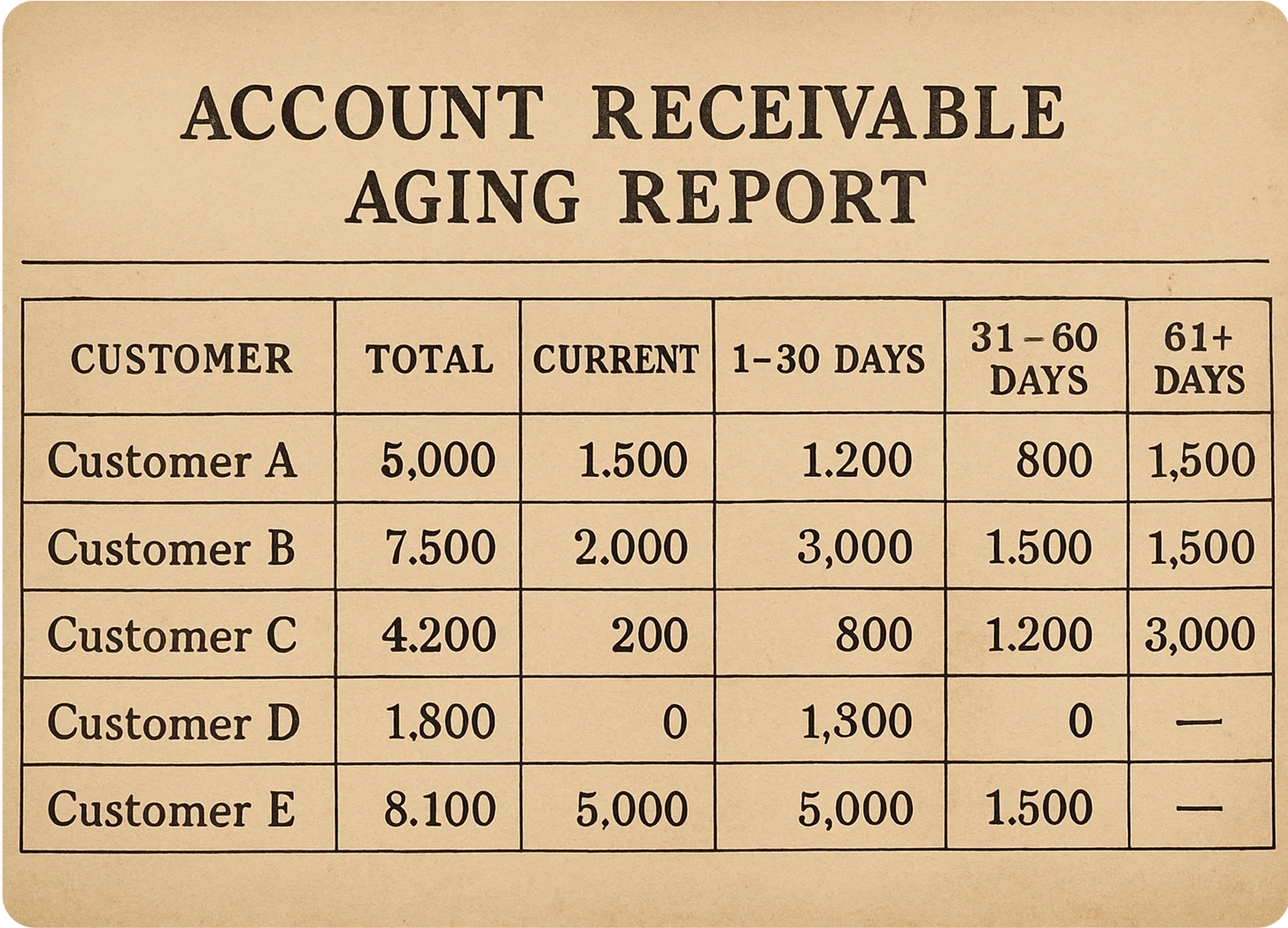

An Accounts Receivable Aging Report provides a detailed breakdown of unpaid invoices, categorized by the length of time they have been outstanding. It typically includes:

- Current (0–30 days)

- Past due (31–60 days)

- Past due (61–90 days)

- Overdue (90+ days)

This categorization enables companies to prioritize collections and assess the creditworthiness of their customers.

Why It Matters for NCRi and Our Clients?

At NCRi, we consider the AR Aging Report a critical decision-making tool. Here’s how it supports our financial strategy:

- Strengthening Collection Practices

If a pattern of overdue invoices emerges, it signals the need to revisit our follow-up processes. Timely follow-ups reduce the likelihood of default and improve cash inflow.

- Evaluating Credit Risk

The report helps us identify customers who may pose a credit risk due to consistent payment delays. This allows us to re-evaluate their credit terms or consider alternate payment arrangements.

- Forecasting Bad Debts

Based on historical data, we can estimate the percentage of receivables that may turn into bad debts. This proactive approach ensures accurate financial reporting and risk mitigation.

- Refining Credit Policies

If we observe frequent delays from particular segments, we adjust our credit policies accordingly—offering early payment incentives or reducing credit limits where necessary.

Timing is Key

While AR aging reports offer valuable insights, their accuracy depends on timing. For example, if invoices are issued at the end of the month and the report is generated shortly after, it may inaccurately reflect receivables as overdue. At NCRi, we align report generation with billing cycles to ensure a clear and accurate financial picture.

The Bigger Picture

The Accounts Receivable Aging Report is more than just a collection tool—it is a reflection of a company’s financial discipline. For businesses that rely on extending credit to clients, understanding and using this report effectively can prevent cash flow disruptions and support long-term growth.

Let’s take control of your receivables—together!

At NCRi, we help businesses implement efficient AR strategies, ensuring better collections, reduced risk, and stronger financial performance.

To learn more or schedule a consultation, visit www.ncri.com today!